Health Insurance Exchanges are one of the most interesting and potentially impactful features of the Affordable Care Act. The exchanges allow eligible individuals to compare health plans on an apples-to-apples basis and choose the one that’s most appropriate for their individual circumstances.

Health plans are interested in participating in these exchanges because they offer one of the few sources of member growth. Federal subsidies make exchange plans affordable for middle income buyers who make too much to qualify for Medicaid.

Not surprisingly, exchange customers are price conscious shoppers. That means plans have to work hard to offer low enough premiums to be competitive. The Affordable Care Act outlaws some of the ways health plans used to stay competitive, such as charging different prices based on health status, refusing to cover certain patients, making exclusions for pre-existing conditions, and offering skinny benefits packages.

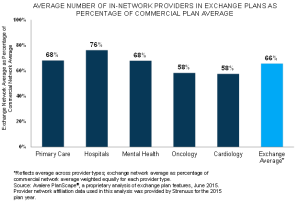

One of the few things plans can do is to offer different networks of physicians, hospitals and other providers. Exchange plans have embraced the concept of “narrow networks,” which offer a smaller than usual collection of providers as a way to hold down costs. I have heard and seen a lot of anecdotes about what this means in practice, but now there is some real data.

Avalere has conducted an analysis of health plans in the top five exchange states to compare the size of exchange plan networks with the size of commercial networks in the same geographies. Sure enough, the plans included an average of 34 percent fewer providers on average, and 42 percent fewer oncologists and cardiologists.

Although anyone’s initial reaction is that a bigger network is better, that is not automatically the case. If the narrower networks exclude the wasteful, low quality providers the result could be increased quality and cost effectiveness. If network inclusion is based just on unit costs, then who knows the outcome on quality. And if fewer providers means it’s harder to get an appointment, that could be problematic. Patients might even end up spending out-of-pocket for out-of-network coverage.

I asked Avalere vice president Elizabeth Carpenter to answer a few questions that immediately came to mind: You report the average, but how much variability is there? How have network sizes changed since last year? How often do exchange members go out-of-network?

Elizabeth answered the first question as follows, “Overall, we did see noticeable variation among the five states we examined. However, interestingly, it was not consistent across provider type. For example, exchange plans in one state may cover a higher percentage of primary care physicians than another state’s exchange plans but may cover a lower percentage of hospitals.”

As I expected, Avalere hasn’t yet done the work to answer the other questions. Clearly there are lots of interesting studies to be done on the impact of exchange plans on costs, quality, and the overall insurance market. I eagerly await them.

Image courtesy of marcolm at FreeDigitalPhotos.net

—

By healthcare business consultant David E. Williams, president of Health Business Group.

from Health Business Blog http://healthbusinessblog.com/2015/07/15/how-narrow-is-a-narrow-network/

via A Health Business Blog

No comments:

Post a Comment